About The Wallace Insurance Agency

Wiki Article

The Only Guide to The Wallace Insurance Agency

Table of ContentsThe Wallace Insurance Agency - An OverviewThe Wallace Insurance Agency for BeginnersThe Only Guide to The Wallace Insurance AgencyGetting My The Wallace Insurance Agency To WorkExcitement About The Wallace Insurance AgencyThe 8-Second Trick For The Wallace Insurance AgencyHow The Wallace Insurance Agency can Save You Time, Stress, and Money.The Main Principles Of The Wallace Insurance Agency

These plans also use some defense aspect, to help guarantee that your beneficiary gets economic settlement should the regrettable take place during the tenure of the policy. Where should you begin? The most convenient method is to start thinking of your priorities and needs in life. Below are some questions to get you began: Are you trying to find greater hospitalisation coverage? Are you concentrated on your family's wellness? Are you attempting to save a great sum for your kid's education needs? Many people begin with among these:: Against a background of rising clinical and hospitalisation expenses, you might desire bigger, and greater insurance coverage for medical expenditures.: This is for the times when you're wounded. As an example, ankle joint sprains, back sprains, or if you're knocked down by a rogue e-scooter motorcyclist. There are also kid-specific plans that cover play area injuries and conditions such as Hand, Foot and Mouth Disease (HFMD).: Whole Life insurance policy covers you for life, or typically up to age 99. https://worldcosplay.net/member/1659169.

The Wallace Insurance Agency Can Be Fun For Everyone

Relying on your protection plan, you obtain a lump sum pay-out if you are permanently disabled or seriously ill, or your loved ones obtain it if you pass away.: Term insurance gives insurance coverage for a pre-set duration of time, e - Home insurance. g. 10, 15, 20 years. Because of the shorter coverage duration and the absence of cash money worth, premiums are generally reduced than life plans, and provides yearly cash money benefits on top of a lump-sum amount when it develops. It usually consists of insurance policy coverage against Complete and Permanent Disability, and fatality.

The smart Trick of The Wallace Insurance Agency That Nobody is Discussing

You can pick to time the payment at the age when your kid goes to university.: This offers you with a month-to-month revenue when you retire, typically in addition to insurance coverage.: This is a means of saving for short-term objectives or to make your money work harder versus the pressures of inflation.

Some Known Details About The Wallace Insurance Agency

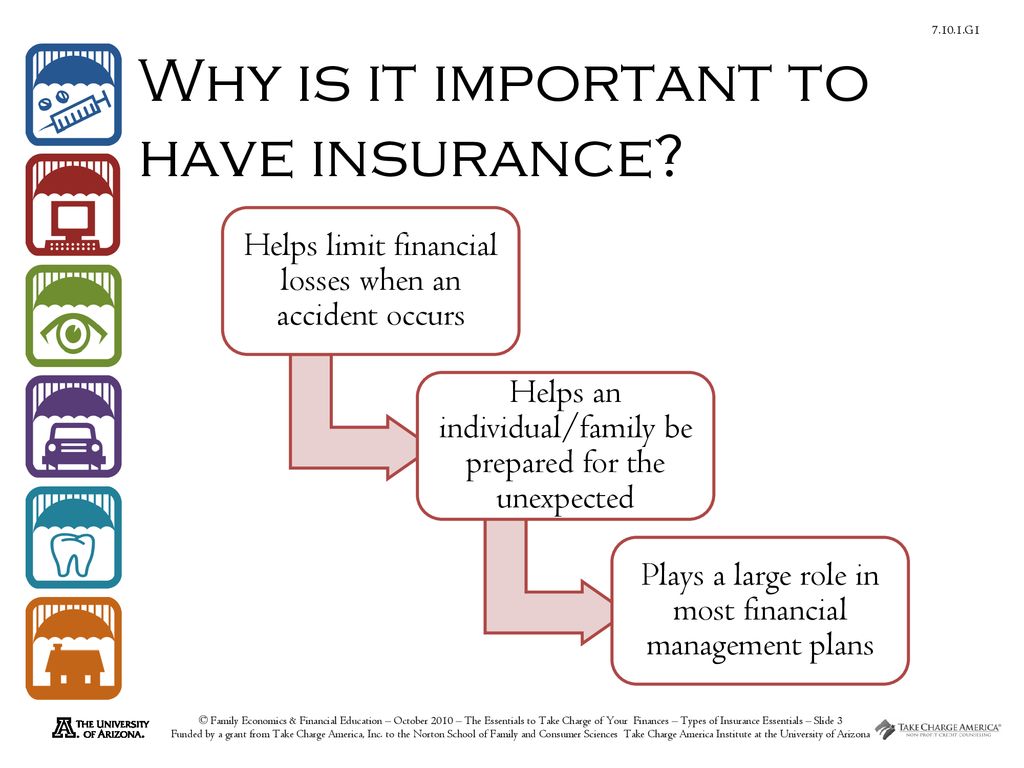

While obtaining different plans will give you more detailed insurance coverage, being excessively shielded isn't a good idea either. To stay clear of undesirable financial tension, contrast the plans that you have versus this list (Affordable insurance). And if you're still not sure concerning what you'll need, just how much, or the type of insurance to obtain, get in touch with a financial advisorInsurance policy is a long-lasting commitment. Constantly be sensible when selecting a plan, as changing or terminating a strategy too soon normally does not produce monetary benefits. Conversation with our Wide range Planning Manager now (This chat solution is offered from 9am to 6pm on Mon to Fri, excluding Public Holidays.) You might also leave your call details and we will certainly obtain in touch quickly.

Excitement About The Wallace Insurance Agency

The finest component is, it's fuss-free we immediately function out your money streams and supply cash pointers. This short article is implied for info only and should not be trusted as monetary recommendations. Before making any kind of decision to purchase, market or hold any kind of investment or insurance item, you need to look for recommendations from a monetary adviser concerning its viability.Spend only if you understand and can monitor your investment. Diversify your financial investments and prevent spending a big section of your cash in a single item company.

The Best Strategy To Use For The Wallace Insurance Agency

Simply like home and auto insurance policy, life insurance policy is necessary to you and your family's financial safety. To aid, allow's discover life insurance in much more detail, how it works, what value it could provide to you, and just how Bank Midwest can help you locate the best policy.

It will help your family members pay off financial debt, receive revenue, and reach significant economic objectives (like university tuition) in the event you're not here. A life insurance policy policy is essential to preparing out these monetary considerations. For paying a month-to-month This Site premium, you can obtain a set quantity of insurance coverage.

What Does The Wallace Insurance Agency Do?

Life insurance coverage is ideal for almost everybody, also if you're young. People in their 20s, 30s and even 40s often forget life insurance policy.The even more time it requires to open a policy, the more threat you encounter that an unexpected event might leave your family members without coverage or financial help. Depending on where you're at in your life, it is necessary to understand exactly which type of life insurance coverage is best for you or if you need any whatsoever.

A Biased View of The Wallace Insurance Agency

A house owner with 25 years continuing to be on their home loan could take out a plan of the very same length. Or allow's claim you're 30 and strategy to have children quickly. In that case, registering for a 30-year policy would lock in your costs for the next three decades.

Report this wiki page